When considering any kind of investment into the property market, whether as a property investor, a first time buyer or an experienced homeowner looking to relocate, understanding regional deposit differences can make you pause for thought. Data provided by Dataloft Inform offers crucial insights into these variations. In this article, we take a look at housing deposits and how they differ across the UK’s regions.

Monitoring Economic Indicators

The first step in understanding the deposit landscape is monitoring various economic indicators. By keeping an eye on these metrics, we gain valuable insight into the UK’s housing market’s current and future trajectory. These indicators not only affect house prices but also influence how much deposit you might need when purchasing a property.

Bank Base Rate and Its Effects

In August 2023, following 14 consecutive interest rate rises, the Bank Base rate peaked at 5.25%. While high, it’s projected that this rate will see a plateau before the year concludes. The rise in rates is primarily an effort to control inflation, which has been running hotter than the targeted 2%. For potential homebuyers, this increase in rates can mean that borrowing is more expensive, which in turn might necessitate a larger deposit to secure favourable mortgage terms.

The Impact of Inflation

While the Bank Base rate aims to curb inflation, it’s anticipated that inflation will remain above the 2% target for some time. This overshoot means that the purchasing power of many will be eroded. As wage growth remains robust and employment figures continue to climb, the property market, especially in sought-after regions, might see increased activity. This could influence the deposit amounts required, making certain areas more competitive and possibly demanding higher upfront deposits.

Anticipated Stability in 2024

Fortunately, there’s a silver lining. The UK economy is poised to embrace stability as we head into 2024. The looming threat of a recession appears to be off the table. However, given the economic indicators, national house prices may experience a dip. Such an adjustment can make properties more affordable and may also affect the average deposit amounts required. Moreover, with a general election around the corner, the property market is bracing for potential policy shifts. It’s expected that there might be incentives for first-time buyers, which could lead to favourable deposit conditions for those looking to step onto the property ladder.

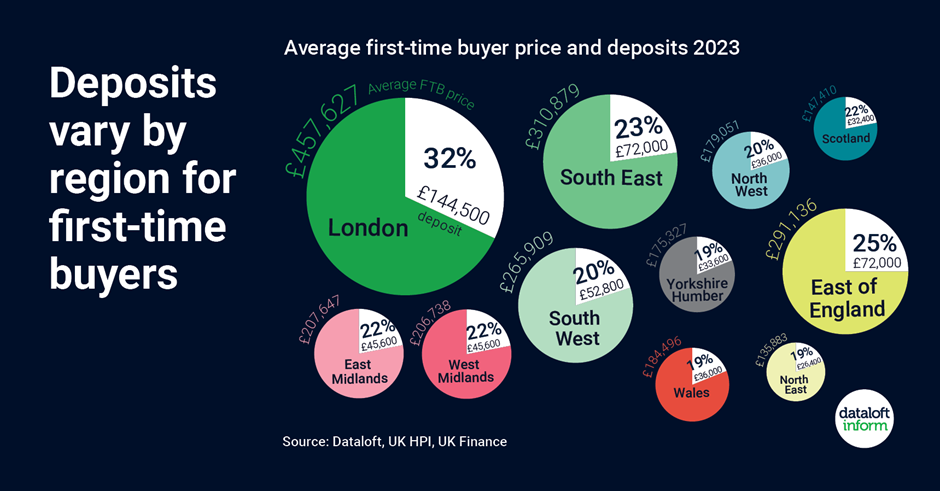

Regional Deposit Differences

While the national outlook provides a broad perspective, it’s essential to understand that deposit demands can vary significantly from one region to another. Factors like local economic conditions, employment rates, and housing demand can influence deposit amounts. For instance, traditionally more expensive areas like London might still require a hefty deposit, even if national trends suggest a decrease. On the other hand, regions with burgeoning local economies might offer more competitive deposit rates.

Deposits are a crucial aspect of the property-buying journey, and understanding regional differences is essential for prospective homeowners. The interplay of economic indicators, from interest rates to inflation, can significantly impact deposit requirements. As the UK moves towards 2024, with potential house price adjustments and anticipated policy incentives for first-time buyers, it’s a pivotal time to stay informed.

If you’re considering entering the property market or wish to understand how these factors might influence your property decisions, get in touch with us. Our team of experts, backed by data-driven insights from sources like Dataloft Inform, is ready to guide you through your property journey.