The journey to homeownership presents numerous challenges for first-time buyers. Recent data from Dataloft reveals a significant shift, with the number of first-time buyers in 2023 dropping by 21% compared to the previous year, amounting to 293,339 individuals taking their first step onto the property ladder. This decline is largely attributed to rising affordability pressures that have made the dream of homeownership increasingly out of reach for many.

The Current State of the Market

This challenging market is a combination of economic factors that have escalated property prices and tightened lending criteria, making it more difficult for first-time buyers to secure a mortgage. The national average property price in England stands at a staggering £358,457, with Wales slightly more affordable at £225,025. These figures place a significant strain on potential buyers, highlighting the need for a focused approach to find value hotspots that offer a more accessible entry point into the market.

Discovering Value Hotspots

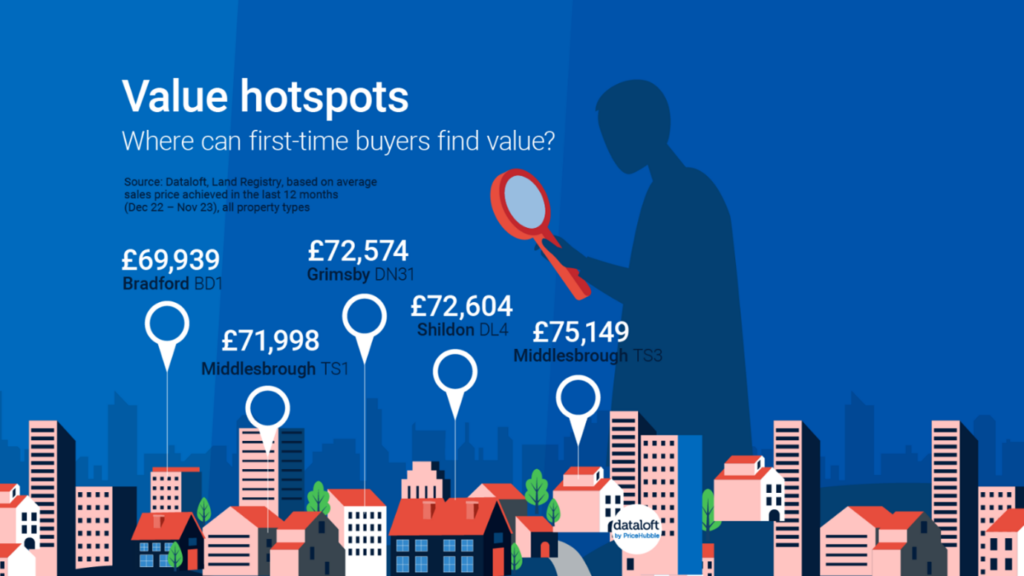

In the search for an affordable home, concentrating on specific areas reveals pockets of opportunity for first-time buyers. One such example is the BD1 postcode in Bradford, where the average property price of £69,939 starkly contrasts with the national averages. This remarkable difference not only showcases Bradford as a value hotspot but also represents a beacon of hope for those wishing to own their home without breaking the bank.

The affordability of properties in Bradford is not an isolated phenomenon. The North of England, in particular, emerges as a region filled with potential for first-time buyers. Over half of the 20 most affordable locations are found in the North East, with four in the North West, three in Yorkshire and the Humber, and two in Wales. This distribution underscores a broader trend of more accessible property prices outside the southern regions of the UK, providing a starting point for those willing to explore these areas.

Top Affordable Locations for First-Time Buyers

Dataloft’s analysis, based on average sales prices achieved in the last 12 months, brings to light several key locations that stand out for their affordability:

- Bradford (BD1): Average price £69,939

- Middlesbrough: Average price £71,998

- Grimsby: Average price £72,574

- Shildon: Average price £72,604

Navigating Your First Home Purchase

For first-time buyers, the journey to homeownership is filled with excitement and challenges. Understanding the market and identifying areas where your budget can stretch further are crucial steps in this journey. The affordability of regions like Bradford and Shildon presents a compelling case for considering locations outside the traditional hotspots. By focusing on these value areas, first-time buyers can take advantage of lower property prices to secure a home that meets their needs and budget.

At Belvoir Estate Agents, we’re committed to helping you find your perfect home. Whether you’re drawn to the vibrant community of Bradford or the charm of Shildon, our team is here to guide you through every step of your property journey. Contact us today to begin your journey to homeownership in one of the UK’s first-time buyer hotspots.