The ebbs and flows of the UK housing market are influenced by a myriad of interconnected factors, from inflation rates and wage growth to employment rates and governmental policies. As we reflect on the current state of the market, we turn to valuable insights provided by Dataloft Inform. Their comprehensive analysis offers a robust understanding of where we stand today and the potential trajectory we might expect in the near future.

Economic Indicators: A Mirror to the Housing Market

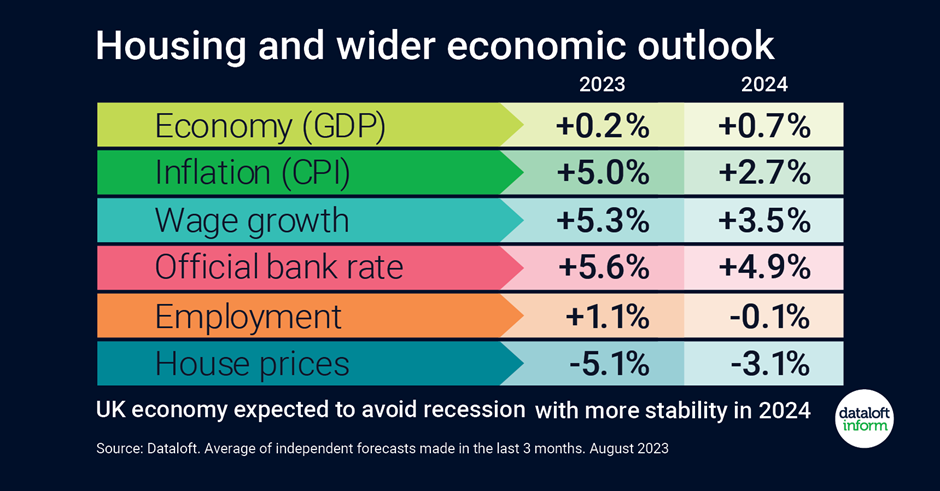

Monitoring various economic indicators not only gives us a snapshot of the current state of the UK’s housing market but also provides a predictive lens, hinting at what the future may hold. These indicators act as a barometer, helping industry professionals and potential buyers alike understand the underlying forces at play.

Interest Rates: The Steady Ascent

Undoubtedly, one of the most influential metrics in the housing market is the Bank Base Rate. August witnessed the rate touching 5.25% – a significant jump, considering this is the outcome of 14 consecutive rate increases. This rate hike strategy is clearly aimed at taming inflation which has been rearing its head for a while now.

Latest projections from Dataloft Inform suggest that this uphill trend in interest rates might soon plateau. With rates poised to peak before 2023 wraps up, there’s a collective hope among potential homeowners and investors that the Bank’s efforts will successfully curb inflation.

The Dual Dynamics: Inflation and Employment

Even though efforts to combat inflation are in full swing, it’s anticipated that inflation will continue to surpass its target of 2%. This is an essential aspect to monitor, especially for potential homeowners, as it impacts the real purchasing power of consumers.

On a brighter note, the UK is witnessing a boon in terms of wage growth and employment. High wage growth paired with increasing employment bodes well for potential homeowners, ensuring that while the property prices might be on the upswing, the capability to invest remains strong.

Forecasting 2024: Stability and Policy Shifts

With the turbulence of 2023, many might wonder what 2024 holds for the UK housing market. Experts from Dataloft Inform provide a glimmer of hope, forecasting more stability for the next year. The anticipated stability stems from the growing consensus that the UK economy will dodge a recession.

However, it’s not all rosy; national house prices are predicted to see a decline. But here’s where political dynamics come into play. With an election looming, it’s expected that new policies will emerge, particularly those tailored to first-time buyers. For those waiting on the sidelines, this might be an opportune moment to make a move.

The housing market, much like any other sector, witnesses its share of highs and lows. Understanding these patterns, backed by reliable data, can greatly aid in making informed decisions. Whether you’re an investor looking for the next opportunity or a first-time buyer waiting for the right moment, keeping an eye on these indicators is paramount.

If you’re considering dipping into the housing market, our expert team at Belvoir is here to guide you every step of the way. Get in touch today and let’s navigate the property journey together!