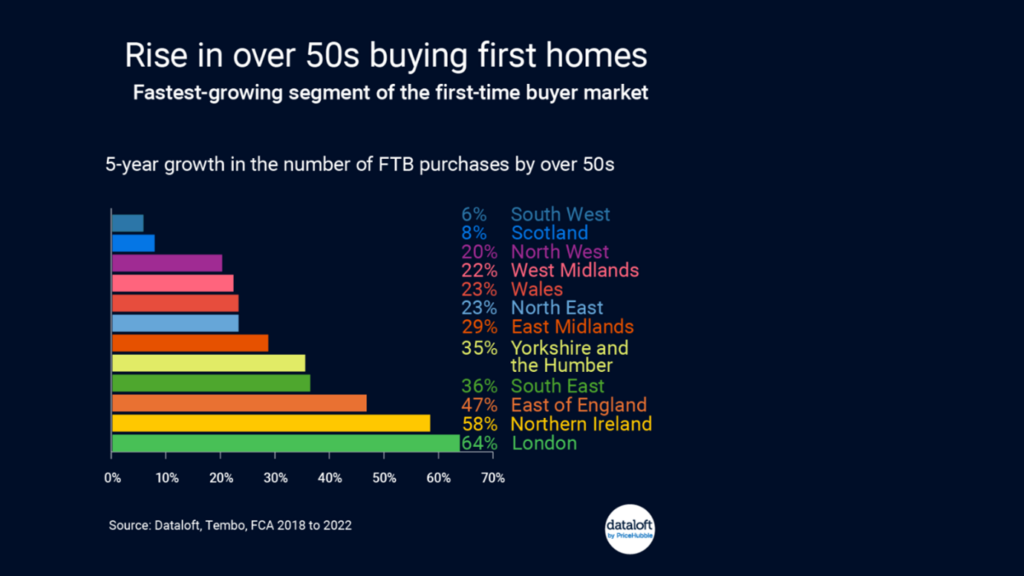

In a surprising twist to the UK’s property market dynamics, there has been a significant rise in the number of first-time buyers who are over 50 years of age. According to recent data analysis provided by Dataloft, this demographic has seen an increase of over 30% in the past five years. This shift highlights changing patterns in homeownership and raises questions about the factors driving individuals to make their first step onto the property ladder later in life. In this article, we delve into the reasons behind this trend and its implications for the housing market.

Understanding the Shift

Traditionally, buying a home was a milestone achieved by individuals in their 20s and 30s. However, the landscape has changed and the data from Dataloft indicates a significant shift towards later-life first-time homeownership. While the proportion of first-time buyers aged 30 and under is on the decline, those over 50 are increasingly making their presence felt in the property market.

The Drivers of Change

A closer look at the factors behind this trend reveals that stretched first-time buyer affordability is a key issue. With house prices rising across the UK, younger individuals find it increasingly challenging to accumulate the necessary savings for a deposit. This financial strain, coupled with stringent lending criteria and the high cost of living, means more people are waiting until later in life to purchase their first home.

Regional Variations

Interestingly, London currently has the lowest proportion of first-time buyers over 50. However, it is experiencing the fastest pace of growth in this demographic, with total purchases by over 50s growing 64% between 2018 and 2022. This rapid increase suggests that even in areas traditionally seen as younger buyers’ markets, older first-time buyers are making significant inroads.

Future Predictions

Projections suggest that over 40s are set to make up a quarter of first-time buyer transactions by 2030, with those in their 50s accounting for 5%. These figures indicate a continuing trend towards older first-time buyers, reshaping the demographics of homeownership in the UK.

The Impact on the Market

This shift has several implications for the property market. It may influence the types of properties in demand, with older buyers potentially seeking different features compared to their younger counterparts. Additionally, lenders and estate agents may need to adjust their services to cater to the unique needs and financial situations of older first-time buyers.

Advice for Older First-Time Buyers

For those over 50 considering buying their first home, it’s essential to carefully evaluate your financial situation, including pension income and long-term financial security. Seeking advice from financial advisers and exploring mortgage options specifically can provide valuable guidance through the purchasing process.

The rise in first-time buyers over the age of 50 is a testament to the changing dynamics of the UK property market. As individuals adapt to economic pressures and personal circumstances, the dream of homeownership is being pursued at all stages of life. This trend not only reflects the resilience and aspirations of older generations but also underscores the need for the housing industry to adapt to a broader range of buyers.

If you’re considering stepping onto the property ladder, whether it’s your first time or you’re moving home, Belvoir Estate Agents are here to guide you through every step of the process. Our team of experts can offer tailored advice to meet your unique needs, ensuring a smooth and successful property purchase. Contact us today to embark on your homeownership journey.

Top of Form