Navigating the property market as a first-time buyer can be a challenging experience, particularly in the current economic climate. With the rise in property prices and the cost of living increasing, first-time buyers are adapting their strategies to make their dream of owning a home a reality. A significant trend has emerged, with more and more first-time buyers opting for longer mortgage terms. This article draws insights from recent data from Dataloft Inform and explores this shift in the mortgage landscape.

The Shift to Longer Mortgage Terms

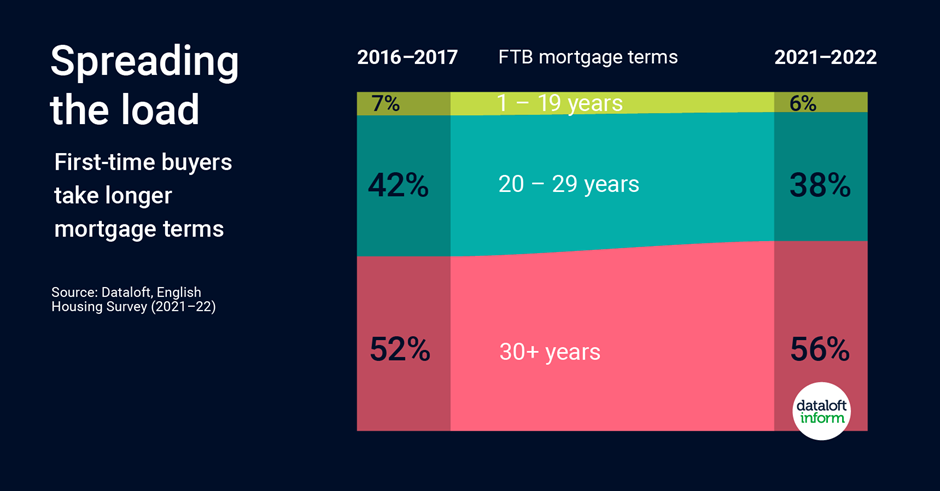

In recent years, the trend among first-time buyers has been to extend the duration of their mortgages. According to data from Dataloft Inform, over half of first-time buyers took a mortgage term of 30 years or longer in 2021–2022. This is a notable increase from 2008–2009, when only one-third of buyers opted for such long terms. This shift is largely attributed to the escalating costs associated with purchasing a first home, prompting buyers to seek more manageable monthly payments.

Balancing Mortgage Terms with Repayment Periods

While longer mortgage terms are becoming more common, they are not the only option for first-time buyers. The data also shows that 38% of first-time buyers chose the more traditional repayment period of 20–29 years. Meanwhile, a small minority (6%) managed to secure mortgages with terms shorter than 20 years. These figures indicate a diverse range of strategies employed by first-time buyers to suit their individual financial situations.

Understanding the Financial Implications

The financial implications of these longer mortgage terms are significant. The average monthly mortgage payment for a first-time buyer is currently £1,194, an increase from £1,048 last year. This rise reflects not only the increased property prices but also the impact of longer mortgage terms on the overall cost of borrowing. First-time buyers are now weighing the benefits of lower monthly payments against the longer-term financial commitment.

Adapting to the Market

To adapt to these market changes, first-time buyers are exploring various options. These include flexible deal structures and considering paying higher deposits to reduce the overall loan amount. Such strategies can help in managing the long-term financial impact while still making the dream of homeownership attainable.

Making an Informed Decision

For first-time buyers, the decision to opt for a longer mortgage term is not one to be taken lightly. It’s essential to consider both the immediate financial relief it offers and the long-term implications. Seeking professional financial advice and thoroughly researching the market can help in making an informed decision that aligns with one’s financial goals and lifestyle.

A New Era for First-Time Buyers

The landscape for first-time buyers is evolving, and the shift towards longer mortgage terms is a significant aspect of this change. While it presents challenges, it also offers opportunities for those looking to enter the property market. By understanding these trends and adapting their approach, first-time buyers can navigate the market more effectively and make their first step onto the property ladder a confident one.