Many Warrington people I talk to in their late 30s to late 40s are relying on the inheritance from their Baby boomer generation parents to help them in their home buying and retirement future.

It is true there is £2 trillion (£2,040,861,524,790 to be exact give or take a few pennies) tied up in equity in the property of everyone in the UK who is aged 65 years and older (to add context to that the NHS costs £181bn per year, well under a tenth of the equity tied up in property).

With additional investments in stocks and shares including buy-to-let properties of around £2 trillion to £3 trillion, it is estimated there is a total of between £4 trillion and £5 trillion that will be inherited in the next two decades from Baby Boomers (born between 1946 and 1964) to both Generation X (born 1965 to 1980) and in some part Millennials (born 1981 to 2000).

This financial realignment, already in motion, is expected to unfold over the next few decades, reshaping the economic landscape for many and offering a glimmer of hope to younger generations facing many financial uncertainties.

The narrative surrounding this monumental transfer of wealth has captured the media’s attention, not only due to the staggering magnitude of the figures involved but also because of the potential implications for the financial well-being of younger generations.

Many Warrington Generation X and Millennials have navigated a turbulent economic landscape marred by skyrocketing student loan debt, escalating living expenses, and a series of economic downturns, including the Global Financial Crash.

These challenges have cast a shadow of financial insecurity over this group of people, leaving many to question their prospects for achieving a stable and secure retirement.

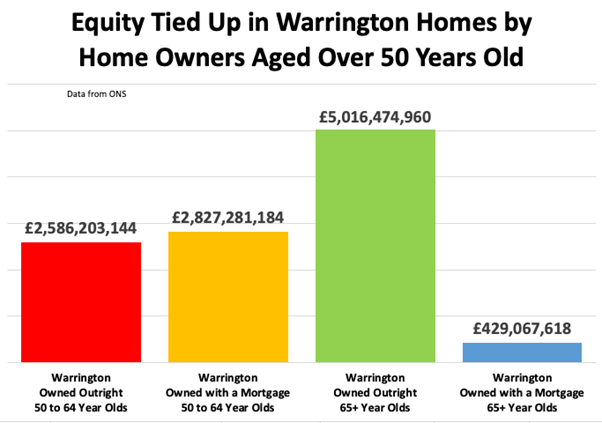

So how much equity is tied up in homes locally? Looking at numbers for our Local Authority.

𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻𝗕𝗮𝗯𝘆𝗕𝗼𝗼𝗺𝗲𝗿𝘀𝗼𝘄𝗻𝟭𝟵,𝟱𝟲𝟬𝗵𝗼𝗺𝗲𝘀𝗼𝘂𝘁𝗿𝗶𝗴𝗵𝘁, 𝘄𝗼𝗿𝘁𝗵 £𝟱,𝟬𝟭𝟲,𝟰𝟳𝟰,𝟵𝟲𝟬𝘄𝗶𝘁𝗵𝗮𝗳𝘂𝗿𝘁𝗵𝗲𝗿𝟭,𝟲𝟳𝟯𝗵𝗼𝗺𝗲𝘀𝘄𝗶𝘁𝗵𝗮𝘀𝗺𝗮𝗹𝗹𝗺𝗼𝗿𝘁𝗴𝗮𝗴𝗲𝗼𝗻𝗶𝘁, 𝘄𝗼𝗿𝘁𝗵𝗮𝗻𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻𝗮𝗹 £𝟰𝟮𝟵,𝟬𝟲𝟳,𝟲𝟭𝟴 (𝗮𝗻𝗶𝗺𝗽𝗿𝗲𝘀𝘀𝗶𝘃𝗲 £𝟱.𝟰𝟱𝗯𝗶𝗹𝗹𝗶𝗼𝗻𝗶𝗻𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻𝗮𝗹𝗼𝗻𝗲).

Despite the allure of this impending wealth transfer, the reality is more nuanced and complex.

A considerable portion of this equity is poised to circulate within already well-off property-owning families. This stark reality serves as a sobering reminder of the wealth disparity that characterises the current economic landscape, tempering expectations of a widespread windfall.

Adding another layer of complexity to this scenario is the looming spectre of healthcare costs for the ageing Baby Boomer population. According to Age UK, on average, it costs around £800 a week for a place in a care home and £1,078 a week for a place in a nursing home. The exorbitant expenses associated with elderly care, including long-term care facilities and home health aides, pose a significant threat to depleting the savings (and equity) of many Baby Boomers, potentially leaving little to be passed on to their heirs.

𝗧𝗵𝗶𝘀𝗽𝗿𝗲𝗱𝗶𝗰𝗮𝗺𝗲𝗻𝘁𝘂𝗻𝗱𝗲𝗿𝘀𝗰𝗼𝗿𝗲𝘀𝘁𝗵𝗲𝗽𝗿𝗲𝗰𝗮𝗿𝗶𝗼𝘂𝘀𝗻𝗲𝘀𝘀𝗼𝗳𝗿𝗲𝗹𝘆𝗶𝗻𝗴𝗼𝗻𝗶𝗻𝗵𝗲𝗿𝗶𝘁𝗮𝗻𝗰𝗲𝗮𝘀𝗮𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹𝘀𝗮𝗳𝗲𝘁𝘆𝗻𝗲𝘁.

The Warrington Baby Boomer generation, having reaped the benefits of significant economic growth and wealth accumulation opportunities, particularly in their property and stock market investments, now faces the daunting challenge of ensuring financial resilience in the face of escalating care home and healthcare costs. The dream of bequeathing a substantial inheritance to the next generations may be at risk, as the financial burdens of healthcare threaten to consume a significant portion of their accumulated wealth.

As the nation grapples with an aging demographic and the accompanying financial challenges, the narrative surrounding this wealth transfer necessitates a closer examination, calling for a more nuanced understanding of the interplay between wealth, healthcare, and intergenerational equity.

𝗠𝗼𝗿𝗲𝗼𝘃𝗲𝗿, 𝘆𝗼𝘂𝗻𝗴𝗲𝗿𝗴𝗲𝗻𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝘀‘ 𝗿𝗲𝗹𝗶𝗮𝗻𝗰𝗲𝗼𝗻𝗶𝗻𝗵𝗲𝗿𝗶𝘁𝗮𝗻𝗰𝗲𝗮𝘀𝗮𝗺𝗲𝗮𝗻𝘀𝗼𝗳𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆𝗵𝗶𝗴𝗵𝗹𝗶𝗴𝗵𝘁𝘀𝗮𝗱𝗲𝗲𝗽𝗲𝗿𝘀𝘆𝘀𝘁𝗲𝗺𝗶𝗰𝗶𝘀𝘀𝘂𝗲𝘄𝗶𝘁𝗵𝗶𝗻𝘁𝗵𝗲𝗲𝗰𝗼𝗻𝗼𝗺𝘆.

The challenges Warrington Gen X and Millennials face, from the burden of student loans to the volatility of the job market, underscore the need for structural reforms that empower individuals to build financial stability independent of familial wealth.

My final thoughts on this are that while a generational wealth transfer narrative offers a compelling vision of financial redemption for Warrington’s younger generations, the reality is fraught with complexities and challenges. Wealth inequality, rising care home costs, and systemic economic barriers necessitate a comprehensive and multifaceted approach to fostering financial security and equity across generations. Every generation needs to take its own personal responsibility regarding their existing housing and living needs and their future retirement needs.

As we navigate this pivotal moment in our country’s history, we must engage in thoughtful dialogue and policy-making that address these critical issues, ensuring a more prosperous and equitable future for all.

Do share your thoughts on the matter with a comment.

P.S. Not all is lost for you older Millennials or Generation Y-ers (those born after 2000), as you will inherit an additional £3.4 trillion in equity owned by the Gen X-ers (those born between 1965 and 1980). Yet how much locally?

𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻𝗚𝗲𝗻𝗫–𝗲𝗿𝘀𝗼𝘄𝗻𝟭𝟬,𝟬𝟴𝟰𝗵𝗼𝗺𝗲𝘀𝗼𝘂𝘁𝗿𝗶𝗴𝗵𝘁, 𝘄𝗼𝗿𝘁𝗵 £𝟮,𝟱𝟴𝟲,𝟮𝟬𝟯,𝟭𝟰𝟰𝘄𝗶𝘁𝗵𝗮𝗳𝘂𝗿𝘁𝗵𝗲𝗿𝟭𝟭,𝟬𝟮𝟰𝗵𝗼𝗺𝗲𝘀𝘄𝗶𝘁𝗵𝗮𝗺𝗼𝗿𝘁𝗴𝗮𝗴𝗲𝗼𝗻𝗶𝘁, 𝘄𝗼𝗿𝘁𝗵 £𝟮,𝟴𝟮𝟳,𝟮𝟴𝟭,𝟭𝟴𝟰 (𝗮𝗻𝗲𝗾𝘂𝗮𝗹𝗹𝘆𝗶𝗺𝗽𝗿𝗲𝘀𝘀𝗶𝘃𝗲 £𝟱.𝟰𝟭𝗯𝗶𝗹𝗹𝗶𝗼𝗻𝗶𝗻𝗪𝗮𝗿𝗿𝗶𝗻𝗴𝘁𝗼𝗻𝗮𝗹𝗼𝗻𝗲).