A little bit of good news this week on the Dundee Property Market as recently released data shows that the number of first time buyers taking out their first mortgage in 2017 increased more than in any other year since the global financial crisis in 2009. The data shows there were 665 first time buyers in Dundee, the largest number since 2006.

I expect in 2018 that this increase of first time buyers will level out and maybe dip slightly as, nationally, figures demonstrate that first time buyer’s average household income was £40,691 and this represented 17.3% of their take home pay. Although, it might surprise readers that it is actually cheaper to buy than it is to rent at the ‘starter home’ end of the housing market. Many of you can remember mortgage rates at 12% … even 15%. Today, at the time of writing this article, I found on the open market, 189 first time buyer mortgages at 95% (meaning only a 5% deposit was required) with 3 year fixed rates from a reputable High Street bank at 2.49% … they even did a 3 year fixed rate 100% mortgage for 2.89%!

Interestingly, looking at the other end of the market, the buy-to-let investment in Dundee was subdued, with only 136 buy-to-let properties being purchased with a mortgage. However, I must stress, whilst there is no hard and fast data on the total numbers of landlords buying buy-to-let, as HM Treasury believes only 30% to 40% of buy-to-let property is bought with a mortgage. This means there would have been further cash only buy-to-let purchases in Dundee – it’s just that the data isn’t available at such a granular level.

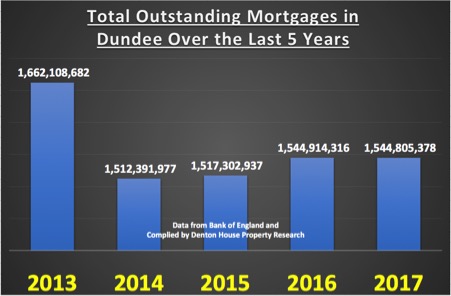

In terms of the level of mortgage debt in Dundee, looking specifically at the DD1 to DD5 postcodes, there hasn’t been much change in this over the last few years.

This is pleasing to see, as new mortgage debt is created by first time buyers, buy-to-let landlords and home movers themselves, that is being roughly equalled by the amount being paid off with mature mortgaged homeowners in their 50’s and 60’s finally paying off their mortgage.

So, what does all this mean for the Dundee Property Market? Well, the stats paint a picture, but they don’t inform us of the whole story. The upper end of the Dundee property market has been weighed down by the indecision around the Brexit negotiations and rise in stamp duty in 2014, when made it considerably more expensive to buy a home costing more than £1m. The middle part of the Dundee property market has been affected by issues of mortgage affordability and lack of good properties to buy, as selling prices have reached the limit of what buyers can afford under existing mortgage regulations. The lower to middle Dundee property market was hit by tax changes for buy-to-let landlords, although this has been offset by the increase in first time buyers.

If you are in the market and selling now and want to ensure you get your Dundee property sold, the bottom line is you have to be 100% realistic with your pricing from day one and you might not get as much as you did say a year ago (but the one you want to buy will be less – swings and roundabouts?). I know it’s not comfortable hearing that your Dundee home isn’t worth as much as you thought, but Dundee buyers are now unbelievably discerning.

So, if you are thinking of selling your Dundee property in the coming months, don’t ask the agent out a few days before you want to put the property on the market, get them out now and ask them what you need to do to ensure you get maximum value in the shortest possible time. I, like most Dundee agents, will freely give that advice to you at no cost or commitment to you.