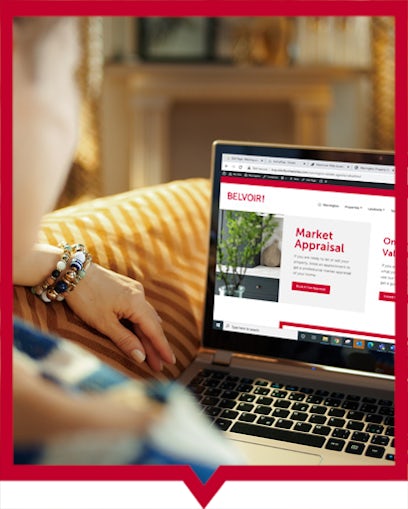

Your local estate and letting agents in Hendon

Estate and Letting Agents for Hendon and surrounding areas.

We are a full service Estate Agent based in the heart of North West London, we launched in April 2016 and have built a reputation as local property experts. We cover Hendon, Colindale (in particular Beaufort Park), Golders Green, Mill Hill and surrounding areas. Our office of letting and estate agents in Hendon operates across Sales, Lettings & Management and have a wealth of experience when dealing with HMO’s. Our office is at 258 Watford Way, Hendon NW4 4UJ – you can’t miss us!