Recent Posts

What is a Duplex apartment? Are duplexes popular in the UK?

This article delves into the world of duplex apartments, exploring what they are, how they differ from other types of properties, and why they might just be the ideal living solution you're looking for.

Read MoreFirst Time Buyer Hotspots: The Most Affordable Places to Live in the UK

Recent data from Dataloft reveals a significant shift, with the number of first-time buyers in 2023 dropping by 21% compared to the previous year

Read MoreWhat is a Link detached house in the UK?

This article aims to demystify the concept, exploring link detached houses in the UK, their benefits, potential drawbacks, and how they compare to other types of residential homes.

Read MoreNumber of Over 50 First Time Buyers Rises by Over 30%

According to recent data analysis provided by Dataloft, this demographic has seen an increase of over 30% in the past five years.

Read MoreSelling Your Home In Spring

This article delves into the specifics, presenting compelling reasons why now could be the perfect time to consider listing your property.

Read MoreWhat is a Mews House? Your Guide to Mews Properties

This guide delves into the essence of mews properties, exploring their origins, characteristics, benefits and considerations for potential owners and investors.

Read MoreThe 10 Most Searched for Areas by Renters

A recent analysis of the UK's busy rental market, courtesy of data from Rightmove, unveils the most sought after locations for renters nationwide. This data paints a vivid picture of the most desirable areas

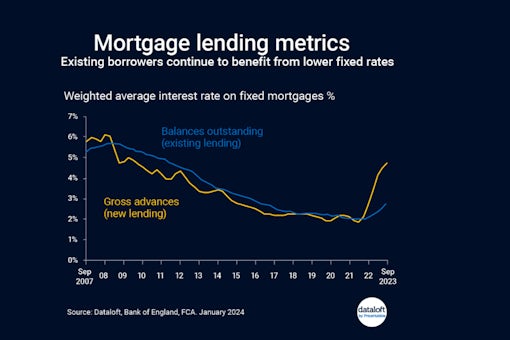

Read MoreMortgage Lending Review

This article, drawing on the latest data from Dataloft, offers an insightful overview of the current state of mortgage lending, the implications for borrowers, and the emerging trends as we navigate through 2024.

Read MoreWhat You Need to Know About Buying a Home With a Partner

Buying a home is a significant milestone and doing it with a partner can be both exciting and daunting. This guide aims to provide comprehensive insights into the critical considerations and legal aspects of purchasing property jointly in the UK.

Read MoreRightmove Calls for More Eco Incentives for Landlords

Renewable or clean energy generation prices and costs, financial concept : Green eco-friendly symbols atop coin stacks e.g. energy efficient light bulb, a battery, a solar cell panel, a wind turbine.

Read MoreDesirable Detached Properties

In the ever changeable UK property market, recent data from Dataloft reveals a significant shift towards a preference for detached homes, indicating their growing appeal among homebuyers. Over the last 12 months, England and Wales have witnessed over 900,000 property transactions, a testament to a still busy housing market. While terraced houses have traditionally dominated the volume of sales, 2023 has introduced a notable change in the market dynamics, with detached and semi-detached houses gaining unprecedented attention.

Read More